I review the appraisal and without much effort make some simple square foot adjustments and “Voila” an instant 20K in value.

Some boring background here:

When Appraisers measure a home they actually measure the home and only count the “Living spaces” they measured BUT they use Measurement’s supplied by County Tax records for the comps; they do not physically measure comps. Well tax records have several measurements in their rolls; Building, Adjusted and Total and you need to account for this BUT my Ace apparently forgot this basic little tidbit.

Now and this is key, there are pictures involved in appraisals and every home used as a comp has a Garage in the photo. So you would assume that each home would be adjusted to reflect a sq ft difference based on this obvious fact (my listing was) BUT NOOO, Ace still uses the total sq ft (which includes garages and overhangs)

With me so far?

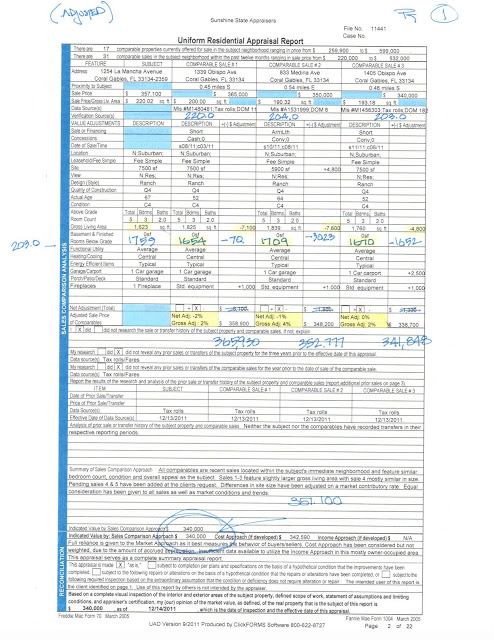

Below is the actual appraisal and my adjustments are in blue ink, all I did was adjust the Sq Ft from the comps from Total to Building off the official tax rolls (Living). Note the smaller numbers in Comps 1 (1654),2 (1709) and 3(1652) and the subject (My Listing) is 1625.

BTW; forget the 1759 in blue on my listing, all I did was use the same rational that the appraiser used for his comps and pulled my Total SQ FT off the tax rolls (garage included)

Note that the original appraised value is 340.0 and with just the sq ft being correct, value climbs and the Contract Price is just fine at 357.0

Think I have a Chance at the Appraisal Challenge?

Not a Chance, no way, no how is ACE going to admit he is wrong and sure enough 3 days later, I get the call “Appraisal stands as written”

Think this is over?

Nope, I don’t give in this easy.